- Mining & Energy

- Posts

- The M&E DISPATCH // 141

The M&E DISPATCH // 141

Carney in Beijing - The Trade Realignment That Changes Everything

THE DISPATCH

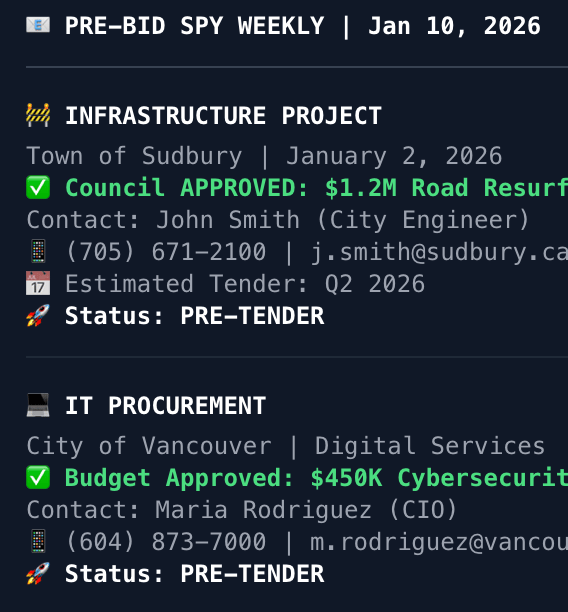

Featured CompanyThe PIP! is a procurement intelligence platform that monitors municipal council meetings across Canada to identify funded opportunities before they become public tenders. By providing early access to project details and decision-maker contact information, Pre-Bid Spy helps businesses build relationships and win contracts before the competition even knows they exist. |

Carney in Beijing

This Changes Everything

These past 72 hours have been extraordinary, and I don't use that word lightly anymore.

Mark Carney just wrapped up the first Prime Ministerial visit to Beijing since 2017. What started as a diplomatic ice-breaker turned into something bigger: a fundamental reset of Canada's energy and resource positioning in a fractured world.

If 2025 was the year of "construction", building pipelines, ramping LNG terminals, getting shovels in the ground, then 2026 is the year of "negotiation." And this trip proves it.

Here's what you need to know, because it's going to reshape where your capital flows, which projects get greenlit, and how you think about Asian markets for the next decade.

The Deal (Yes, There's Actually a Deal)

The EV-for-Canola Swap

Carney and Xi announced a tariff-quota framework that's been called a "landmark" deal. Here's the mechanics:

49,000 Chinese EVs can enter Canada annually at a 6.1% tariff (not the punitive 100% we slapped on them in October 2024)

That quota jumps to 70,000 by year five

China cuts canola seed tariffs from ~85% down to ~15% effective March 1, 2026

Translation: Saskatchewan farmers get $3 billion in unlocked export orders. Potash demand improves. Seafood exporters (lobsters, crabs, peas) get relief on Chinese anti-dumping tariffs through at least year-end 2026.

Ford is furious about the EV quota (and he's not wrong to be concerned about auto manufacturing impacts). But the real story isn't the cars, it's what this signals about Canada's trade priorities.

The Energy Memorandum of Understanding

This is the one that matters for you.

Canada and China signed a strategic energy cooperation framework that covers:

Oil and gas resource development

Crude oil, LNG, and LPG trade

Uranium exports (specifically called out)

Emissions reduction collaboration

Joint ventures based on market principles

Let me be direct: Carney's government said it will welcome Chinese investment in Canadian energy, including the oil sands.

That's not negotiable language. That's permission.

What This Means for Mining & Energy (The Real Story)

Uranium Gets a Strategic Customer

Saskatchewan uranium producers just got a gift-wrapped deal.

Uranium prices hit $84.95/lb on January 15, up 15% year-over-year. China is building nuclear capacity at a pace that makes most Western nations look like they're sleepwalking. The energy MOU specifically positions Canada as a "key potential partner in the responsible production and dependable global supply" of uranium.

This isn't handwaving. This is official government backing for Saskatchewan uranium to flow into Chinese reactors.

LNG Canada Ramp-Up Gets a Market

LNG Canada shipped its first cargoes to Asia in summer 2025. This MOU creates a ministerial dialogue to expand those flows.

With Alberta natural gas prices forecast to hit $3.30/mmBTU in 2026 (up from $1.70 in 2025), stronger Asian demand could provide floor prices that your portfolio depends on. Data centers burning 20+ GW in Alberta means we need that LNG outlet more than ever.

But here's the real prize: the Northwest Coast Pipeline just got political air cover.

If you've been following our coverage, you know the Alberta Indigenous co-owned pipeline project is pitched to cabinet by July 2026. It targets deep-water Pacific ports for Asian markets. That pipeline needs an anchor customer. China is the obvious buyer for bitumen when it hits tidewater.

Carney's energy MOU lays the diplomatic groundwork for that deal.

The Indigenous Ownership Model Goes Mainstream

Carney explicitly highlighted Indigenous co-ownership and "Indigenous leadership" in his pitch to China. The 50% First Nations stake in the Northwest Coast pipeline? It's no longer a regulatory requirement, it's a competitive advantage in international trade negotiations.

If China buys into this narrative (literally, through project investment), it validates the Indigenous equity model for every megaproject on the board: mining, LNG, pipelines, ports.

That's a massive policy shift.

Critical Minerals Are Now a Political Football

Silver hit $92/oz this week, up 153% year-over-year. The U.S. added it to its critical minerals list. Canada still won't.

Here's the uncomfortable truth: Carney's energy deal opens the door to Chinese investment in Canadian mining, including battery minerals and rare earths. At the same time, Trump's administration is tightening supply chain controls and pushing for Western nearshoring of critical minerals.

Canada is caught in the middle. We want Chinese capital in our mines. We also want to be trusted by the U.S. for supply security.

That tension is about to get very real.

The Strategic Pivot (Why This Matters)

Carney flew to Beijing to send one message: Canada is de-risking from the U.S.

Trump's tariff threats. The CUSMA exemption review looming in 2026. His public musings about Canada as the "51st state." It's spooked Ottawa.

Carney explicitly said this trip aims to "double non-U.S. exports in the next ten years."

For resource and energy companies, that translates to:

Government priority for Asian export infrastructure (pipelines, LNG, ports, mines)

Policy support for Chinese investment in resource projects (with national security reviews as guardrails)

A deliberate, strategic pivot away from U.S. market dependency

Whether that works, or whether Trump retaliates, is the billion-dollar question.

But it signals where Ottawa's head is at. And it means 2026 is shaping up to be the year where Asian markets stop being "nice to have" and become "essential."

The deal with China is real. But so are the risks.

Carney has placed a big bet that Asian markets can cushion Canada against U.S. trade volatility. Whether that bet pays off, and whether Trump lets it, will define resource sector investment for the next five years.

// THE DIRT

Kingfisher Metals Reports 889.35 meters of 0.47% CuEq and 721.7 meters of 0.46% CuEq from surface at Williams, HWY 37 Project, Golden Triangle, British Columbia

Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce further results fro...

Delta Reports Multiple Gold Intercepts (4.25 G/T Gold over 11.8 metres and 1.37 g/t over 10.5 metres) at new Shabaqua target 1.3 kilometres west of Eureka Gold Deposit

Step-out drilling at Eureka (South and West) gold deposit continues to expand the mineralized footprint January 13, 2026/ Toronto, ON / N...

FEATURED RELEASEDo you have a release you want to make sure is covered? Here’s the spot for it. Hit reply and I’ll fill you in. |  FEATURED STORYHave a story or update you want covered? Here’s the spot for it. Hit reply and I’ll fill you in. |

A Closing Thought

NOTES FROM THE NORTH

Off to Peterborough for the weekend, kids are in the middle of a tournament and we’re going to go check out some games “close to home”.

I’ll let you know how it goes.

-Lee

“Karma Jujitsu, find us.” - Sign on the way to the rink, sometimes messaging just works.