- Mining & Energy

- Posts

- The M&E DISPATCH // 140

The M&E DISPATCH // 140

If this sounds familiar, it is. Same play, different industry, new players. Wanna make some bets on the outcome this time around?

THE DISPATCH

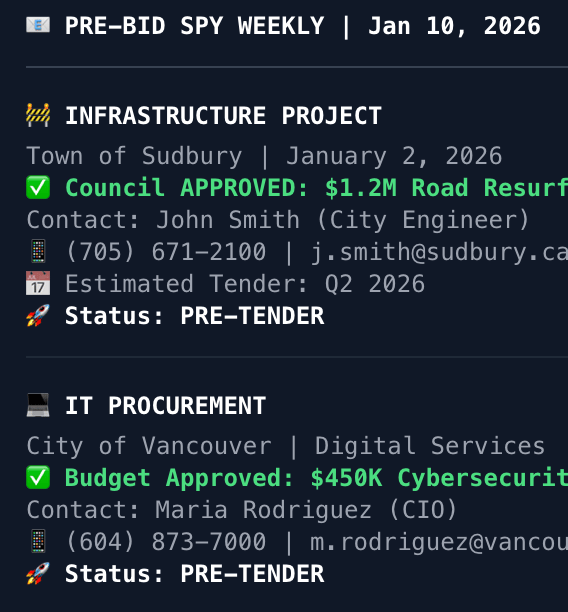

Featured CompanyThe PIP! is a procurement intelligence platform that monitors municipal council meetings across Canada to identify funded opportunities before they become public tenders. By providing early access to project details and decision-maker contact information, Pre-Bid Spy helps businesses build relationships and win contracts before the competition even knows they exist. |

Straight out of the grocery and telecom playbook…

Hello? Operator, get me the 1980s please

BHP just confirmed it won't counterbid for Glencore, clearing the path for Rio Tinto's $207 billion mega-merger that would dominate global copper supply. The deal creates a behemoth controlling massive portions of copper, nickel, cobalt, zinc, and iron ore, materials essential for AI infrastructure and the clean energy transition.

Sound familiar? It should.

In Canada, forty years of grocery consolidation left Loblaws, Sobeys, and Metro controlling roughly 80% of the market. Telecom's Big Three, Bell, Rogers, and Telus, own over 90% of wireless infrastructure, charging Canadians 170% more than Australians for cellphone service. The 1985 Competition Act explicitly prioritized creating "internationally competitive Canadian champions" over domestic competition. Minister Michel Côté called it the "cornerstone" of making Canada competitive internationally. Four decades later, Canadians pay some of the highest grocery and telecom prices in the developed world while those "champions" squeeze them relentlessly.

Mining is now sprinting down the same path. From January 2024 to mid-2025, mining companies announced 18 deals exceeding CA$1 billion, totalling $47 billion. Anglo American and Teck Resources are merging to form the world's fifth-largest copper producer in the second-biggest mining deal ever. The justification is identical: economies of scale, global competitiveness, access to capital.

The Junior Miner Extinction Event

While mega-deals dominate headlines, junior mining companies, the traditional discoverers of tomorrow's deposits, faced a staggering 52% decline in equity financing in 2023. Off-mine-site exploration spending fell by $403 million to $2.2 billion, with British Columbia down $163 million, Ontario down $136 million, and Quebec down $58 million.

Despite record-high gold prices, exploration spending in British Columbia dropped 14% in 2024, with gold exploration down 24%. There are an estimated 2,000 junior mining companies worldwide, yet only a tiny fraction ever reach production. Many have become zombie operations, maintaining skeleton crews while waiting for market conditions that may never return.

This creates a vicious cycle. Cash-rich majors acquire promising juniors at fire-sale valuations, particularly those with proven resources but insufficient capital to advance projects. For well-funded entities, this environment presents a "rare opportunity to build substantial project portfolios at historically attractive valuations". For Canada, it means fewer head offices, with investment decisions migrating to Melbourne, London, or Zug.

The Processing Gap Nobody Talks About

Here's what the consolidation cheerleaders won't mention: China controls 50% to 100% of processing capacity for lithium, aluminum, and graphite. The strategy is deliberate, flood markets, drive down prices, control midstream and downstream operations. Canada focuses on mining while ceding the value-added processing that determines supply chain security.

This gap represents "perhaps the most significant structural challenge to supply chain security, more acute than mining capacity itself". Even if Canada successfully mines critical minerals, without domestic processing, those materials ship to China for refining before returning as finished products. The mining consolidation wave does nothing to address this fundamental vulnerability, if anything, it exacerbates it by concentrating decision-making in multinational entities optimizing global portfolios rather than national security interests.

The Regulatory Failure

Canada's competition policy remains fundamentally conflicted. While the Competition Act now includes structural presumptions against mergers exceeding 30% market share, enforcement remains weak. The Competition Bureau concluded that "mobile wireless prices in Canada are higher in regions where Bell, Telus and Rogers do not face competition from a strong regional competitor", yet the oligopoly persists.

Mining will likely follow the same pattern. Anglo-Teck is heading toward EU antitrust approval under a "simplified procedure" suggesting regulators don't see significant competition concerns. The Rio-Glencore deal will face scrutiny, but approval with minor divestments seems likely. The fundamental question, whether allowing a handful of companies to control global critical mineral supply serves public interest, receives little serious examination.

The February 5 Deadline

Rio Tinto has until 5:00 p.m. London time on February 5, 2026 to announce a firm intention to proceed with the Glencore deal or walk away. If Rio walks, attention returns to BHP, whose cooling-off period on Anglo American expires mid-2026.

But even if the Rio-Glencore deal collapses, the consolidation trend continues. The structural factors pushing toward oligopoly, reserve depletion, rising costs, capital concentration, junior sector collapse, remain in place.

We've built that future in grocery and telecom. Mining offers a chance to choose differently. The question is whether anyone's paying attention before the consolidation wave makes the choice for us.

// THE DIRT

Ccc Provides Updates On Its Exploration Program In The Ring Of Fire And On Efforts To Transfer Its Subsidiary’s Corridor Claims To A Trust For An Indigenous Enterprise

The CanadianChrome Company Inc. PRESS RELEASE No. 387 Subordinate shares issued & outstanding (CSE-CACR) 1,682,262,132 Convertible into M...

Voyageur Pharmaceuticals Strengthens Scientific Team by Adding Dr. Brian Mueller as Director of Chemistry and Secures Exclusive Ownership of Iodine Extraction Technology

Voyageur Pharmaceuticals Strengthens Scientific Team by Adding Dr. Brian Mueller as Director of Chemistry and Secures Exclusive Ownership...

FEATURED RELEASEDo you have a release you want to make sure is covered? Here’s the spot for it. Hit reply and I’ll fill you in. |  FEATURED STORYHave a story or update you want covered? Here’s the spot for it. Hit reply and I’ll fill you in. |

A Closing Thought

NOTES FROM THE NORTH

Last week I was so caught up in hockey and global events that I failed to pay attention to my email not routing correctly.

If you sent something in the past little but and it bounced, please resend it.

Also… things are getting heated today in the middle east, I worry that there’s some action about to take place in Iran. Might be worth readying up on the state of things there if you’re not quite up on it.

-Lee

“Karma Jujitsu, find us.” - Sign on the way to the rink, sometimes messaging just works.