- Mining & Energy

- Posts

- The M&E DISPATCH // 139

The M&E DISPATCH // 139

The Question David Eby Got Right - Oh I know, a headline like that will get me unsubscribes, here me out.

THE DISPATCH

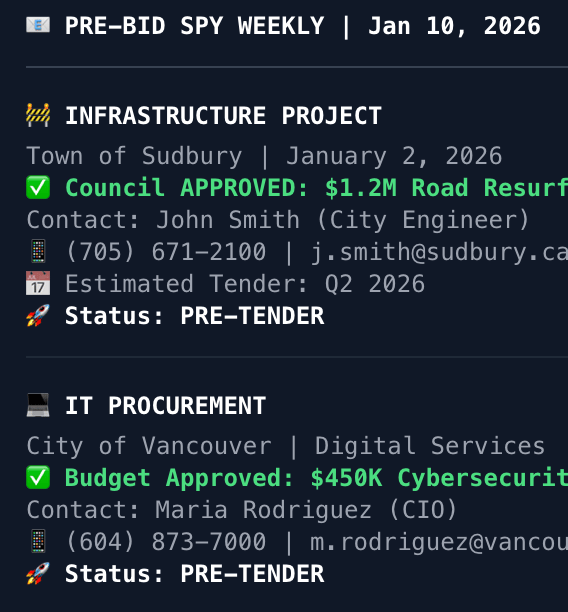

Featured CompanyThe PIP! is a procurement intelligence platform that monitors municipal council meetings across Canada to identify funded opportunities before they become public tenders. By providing early access to project details and decision-maker contact information, Pre-Bid Spy helps businesses build relationships and win contracts before the competition even knows they exist. |

Oh I know, a headline like that will get me unsubscribes, here me out.

The Question David Eby Got Right

While premiers argue about pipelines, BC's refinery proposal reveals the wealth Canadians are leaving on the table...

David Eby said something this week that most dismissed. The BC Premier suggested Canada should "pivot" from pipelines to refineries, build domestic refining capacity instead of shipping raw crude overseas. Keep the value-added processing here.

Analysts were swift: refineries are uneconomic, too costly, politically popular nonsense.

Except Eby's core point, that Canada systematically exports raw materials while importing finished products, is undeniably true. And after Venezuela, it's become strategically indefensible.

The Numbers That Tell the Story

Canada produces 5 million barrels per day of crude oil but has only 1.9 million barrels per day of refining capacity. We should be self-sufficient in gasoline, diesel, and jet fuel.

We're not.

Canada imports 429,000 barrels per day of refined products, roughly triple the volume we imported in 2010. Most comes from the U.S., 330,000 barrels per day, or 78 percent of imports.

The pattern is absurd: we import American condensate to blend with Alberta bitumen for export through Trans Mountain. That bitumen gets refined in Houston. We then buy back the gasoline and diesel.

We're importing diluent, exporting diluted crude, refining it overseas, and importing the finished product. That's not energy policy. That's economics designed backward.

Where the Value Gets Created

Global composite refining margins hit $8.37 per barrel in May 2025. When crude prices fall, refining margins expand because refiners keep more of the spread. That value should stay in Canada.

Canadian refineries contributed $31 billion in export value in 2024. But refined product imports mean we're systematically choosing to capture the lowest-margin part of every value chain while shipping processing to foreign competitors.

Canada exports raw materials (stage 1-2 products) at positive trade balances but imports fabricated goods (stage 3-4) at negative balances. Natural resource exports comprise 58 percent of total merchandise exports. We rank last among peer countries in high-value-added manufacturing.

Eighty-four percent of Canadians want more value-added manufacturing at home. Manufacturing already represents 25 percent of GDP when you include supply chains. The opportunity cost of shipping raw materials is enormous.

Why Eby's Timing Matters

His specific refinery proposal may not be the commercial answer. But the underlying question is exactly right. Why is Canada making massive public investments to support raw material exports to a country that just demonstrated it will use military force to control resource supply chains?

The Venezuela operation fundamentally changed the risk calculus. The U.S. just showed it will overthrow foreign governments to secure heavy crude access. Canada has 168 billion barrels of proven reserves already flowing to American markets through established infrastructure.

When you're exporting raw materials to a country that treats resource access as a military priority, optimizing for raw exports becomes strategically indefensible. It's not just about refining margins anymore. It's about who controls the value chain.

Every barrel of bitumen that leaves Canada as diluted crude and returns as gasoline represents wealth we're choosing not to capture. Every ton of lithium ore shipped to China for processing represents jobs we're choosing not to create. Every cubic meter of natural gas exported as raw commodity instead of petrochemicals or plastics represents value-added activity we're ceding to other jurisdictions.

That was always economically questionable. After Venezuela, it's sovereignty risk.

The Real Competition

The debate has focused on the wrong question: whether Venezuelan crude will displace Canadian bitumen in Houston refineries over five to seven years.

It won't, likely. Venezuelan production rebuild timelines are measured in decades, not years.

But that's not the real competition.

The real competition is between fragmented Canadian provincialism that optimizes for raw material exports versus integrated American strategic control that just demonstrated it will use military force to secure resource supply chains.

Eby probably didn't intend his refinery comment as fundamental critique of Canada's entire resource export model. But that's exactly what it should be.

The Venezuela operation happened six days ago. Canadian energy stocks sold off on fears about market share. Alberta demanded faster pipelines. BC countered with refineries instead.

Everyone's still asking the wrong question.

The right question is why Canada is optimizing its entire resource policy for raw material exports to a country that just showed resource access is now a military priority, not a commercial transaction.

The wealth Canadians are leaving on the table by shipping raw materials out and importing finished products back isn't just an economic cost anymore.

After Venezuela, it's a sovereignty risk we can no longer afford.

// THE DIRT

Midland, en partenariat avec Rio Tinto Exploration Canada, recoupe de nouvelles pegmatites à lithium et césium lors du programme de forage 2025 sur le projet Galinée

Montréal, le 8 janvier 2026.Exploration Midland inc. (« Midland ») (TSX-V : MD), en partenariat avec Rio Tinto Exploration Canada Inc. («...

FEATURED RELEASEDo you have a release you want to make sure is covered? Here’s the spot for it. Hit reply and I’ll fill you in. |  FEATURED STORYHave a story or update you want covered? Here’s the spot for it. Hit reply and I’ll fill you in. |

A Closing Thought

NOTES FROM THE NORTH

The kids are off to an ok start in Delta, suffered a 3-1 loss in their first game last night, a bit of scheduling gamesmanship coupled with poorly timed penalties had them behind early. They have a chance at redemption in a few hours here, a mid day game on the back of a decent rest should give them an advantage.

That’s it though, right? Finding the little bits of optimism to lean on and using that to build momentum. Really, it’s all any of us can do.

-Lee

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could. - Rudi Dornbusch