- Mining & Energy

- Posts

- The M&E DISPATCH // 136

The M&E DISPATCH // 136

Remember when we'd get together over coffee? When Tim Horton's had a baker and made their own donuts in store?

THE DISPATCH

Featured CompanyIn future editions I’m going to use this space to put the spotlight on the companies that are putting in the work. Some may be known, some may be unheard of startups, all will be worthy of a look. |  |

From the comfort of our reading rooms (you have one, right?)

2025 MINING & ENERGY YEAR IN REVIEW

2025 was the year geopolitics crashed the commodity party, trade wars rewrote supply chains, and Canadian mining and energy professionals discovered that predicting the next crisis is harder than getting a permit approved. Here's what actually happened:

The Geopolitical Earthquake

Ukraine's ongoing war kept European energy markets in a state of constant jitters, with every drone strike on Russian infrastructure rippling through global oil supply calculations

Russian shadow fleet tankers continued their ghostly dance around sanctions, ferrying oil while keeping maritime insurers and energy traders perpetually anxious about actual supply levels

Annexation rhetoric made headlines, first calls to annex Canada, then Greenland, reminding the mining and energy sectors that resource nationalism and geopolitical risk aren't theoretical concepts anymore

Mark Carney, the investment banker, took over as Prime Minister in September, bringing Bay Street credibility (and complicated symbolism) to the resource extraction conversation

The Commodity Rollercoaster

Lithium prices moonwalked backward, leaving battery hopefuls wondering if the EV boom was real or just another commodity mirage

Oil swung wildly, partly thanks to Ukraine uncertainty, partly thanks to broader economic signals that nobody could quite read

Gold sat quietly profitable while everyone else argued about whose fault the chaos was

Copper and other base metals navigated the tightrope between energy transition demand and global slowdown fears

The Tariff Wars

Trade tensions threatened the supply chains that mining and energy companies depend on, creating real uncertainty around equipment, materials, and cross-border talent movement

Mining operations relying on integrated North American supply chains had to rethink their entire playbooks

Energy companies watched potential trade disruptions reshape their bottom-line assumptions in ways no single commodity price could explain

The Energy Transition Paradox

Renewable energy projects lined up in record numbers, but financing remained spotty and execution even spottier

Traditional energy producers continued their signature move: investing in transition while also investing in coal and oil (diet pizza approach)

The real winners were firms flexible enough to hedge across geopolitical risk, commodity exposure, and energy transition plays simultaneously

The Permitting & Regulatory Mess

Provinces competed aggressively to lure mining projects with promises of expedited approvals and tax breaks

Most companies nodded politely while their permitting teams scheduled longer vacations

Canada's permitting process remained stubbornly slow, despite rhetoric about acceleration

Mark Carney's arrival created quiet speculation about whether Bay Street connections would actually change the regulatory conversation (verdict: too early to tell)

The Labor Crisis (Still Real)

Engineers, equipment operators, and permit specialists could name their price

Companies that could hire were doing it aggressively

Companies that couldn't were scrambling

The shortage showed no signs of easing

The Elbows-Up Scramble

Mineral-rich nations leveraged their strategic importance in an increasingly tense geopolitical environment

Energy producers jostled for market share while managing trade uncertainty

Investors tried to figure out which bets would actually survive the next geopolitical surprise

Everyone was positioning, hedging, and watching their neighbors very carefully

The Bottom Line

Despite all the chaos, the trade wars, the geopolitical tremors, the annexation jokes, the Ukraine-fueled energy shocks, the permitting nightmares, the fundamentals never disappeared. The world still needed minerals. Battery demand kept growing. Oil kept flowing. And thousands of Canadians kept showing up to work in the prairies and the Canadian Shield, moving dirt and rock, keeping the gears turning.

Mining and energy in Canada proved resilient in ways that surprised even seasoned professionals. You weathered trade uncertainty. You adapted to transition rhetoric. You watched your resources become even more strategically important in a world that suddenly cared a lot more about who controls what.

Here's to 2026!

// THE DIRT

FEATURED RELEASEDo you have a release you want to make sure is covered? Here’s the spot for it. Hit reply and I’ll fill you in. |  FEATURED STORYHave a story or update you want covered? Here’s the spot for it. Hit reply and I’ll fill you in. |

Visionary Voices

A CONVERSATION WITH… YOU!

Once a month I’d like to sit down with a reader and tell their story. I’d like that to be you. Hit reply and let me know if you, or someone you know, has a story to share with readers.

READ THE FULL INTERVIEW →

The Canada Edit

NORTHERN DISCOVERIES

There is a lot stuff worth sharing in Canada and one of the challenges I’ve faced is that it’s really hard to work these into the story. So I’ve created a section that’s simply things I’ve found that I think are interesting. Like a pocket full of rocks.

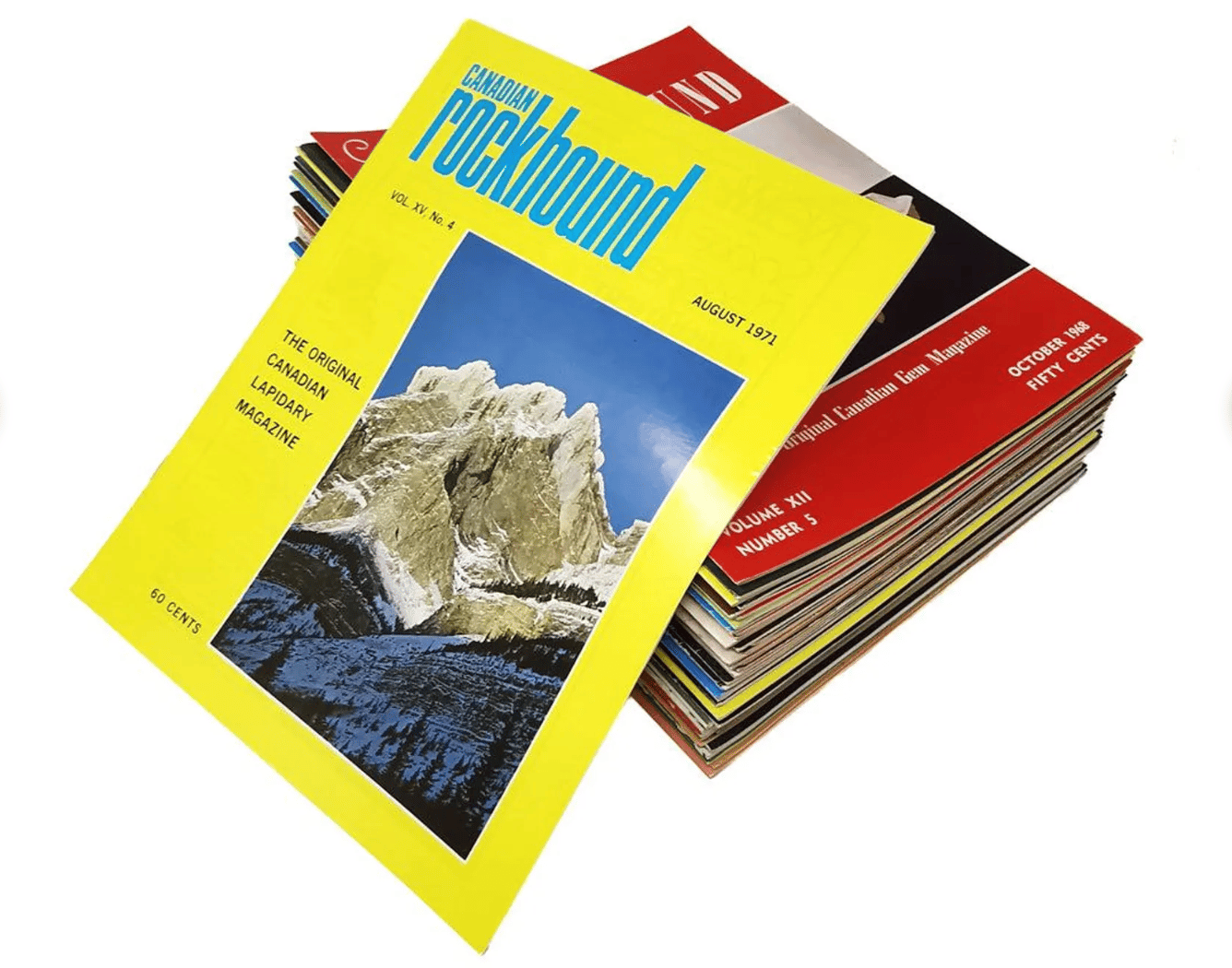

From the “Today I learned” files. | If you’ve never been, it’s beside the Conv Ctr | A bit of time travel, I have a few of these |

A Closing Thought

NOTES FROM THE NORTH

“There is a certain peace that comes from sharing everything.”

I’ve been very privileged to share this space with you all through 2025 and my hopes if that this new format will help make this far more valuable to you this year.

I hope you’ve had some lovely time over the holiday break to spend some time with yourself, and those you care about, to reflect and plan.

What an incredible journey we’re all on, hurtling through space on this resource rich globe we call home.

Until next time,

-Lee

Life’s journey is the quarter you put in an arcade machine and got double credit for.